Embarking on your investment journey can feel overwhelming, but understanding your unique investor profile is the first step toward financial clarity and success.

This process is not just about numbers; it's about aligning your deepest aspirations with a strategy that fits who you are.

By delving into your financial goals and risk appetite, you can build a path that is both empowering and effective, setting the stage for a secure future.

Investor profiling is a systematic approach to gather and analyze key aspects of your life and finances.

It aims to create a tailored strategy that resonates with your personal circumstances and dreams.

The primary purpose is to ensure that your investments are not just profitable but also meaningful and sustainable over time.

This customization helps in managing risk effectively and promoting long-term financial success without unnecessary stress.

Financial advisors often initiate this process during client onboarding to foster trust and make informed decisions.

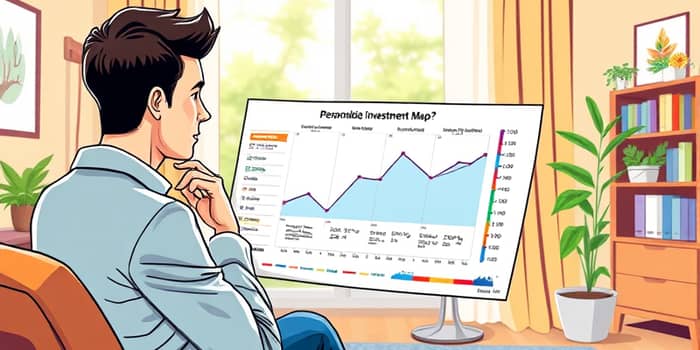

Your investor profile is built on several critical elements that interact to shape your strategy.

Understanding these components allows for a holistic view of your financial landscape.

Here is a breakdown of the essential factors:

Each component plays a vital role in crafting a strategy that is uniquely yours.

For instance, a longer time horizon might allow for higher risk exposure due to the dilution of volatility over years.

Reflecting on these factors can prevent mismatches and enhance your investment confidence.

Based on these components, investors are often categorized into profiles to guide asset allocation.

These types help in aligning products and strategies with individual needs.

Psychometric tools can further refine these categories by assessing psychological factors like composure and confidence.

Regulatory frameworks, such as US FINRA rules, emphasize the importance of these profiles in ensuring suitable investments.

Financial advisors are instrumental in the profiling process, providing expert guidance and support.

They use various methods to gather and analyze your data effectively.

Tools enhance this process by offering accessible and accurate assessments.

This collaborative approach ensures that your investments are not only strategic but also adaptable.

Investor profiling is not a one-time event; it requires continuous attention and adjustment.

As life unfolds, your financial situation and goals may shift, necessitating regular reassessment.

However, challenges exist that can complicate the profiling process.

Acknowledging these challenges empowers you to approach profiling with honesty and foresight.

Taking proactive steps can demystify the profiling process and make it more engaging.

Start by setting aside time for self-reflection and documentation.

This active engagement fosters a deeper connection with your financial journey.

It transforms abstract concepts into tangible actions that drive progress.

Understanding your investor profile is more than a financial exercise; it's a journey of self-discovery.

It empowers you to make choices that resonate with your values and aspirations.

By embracing this process, you can navigate market uncertainties with confidence and clarity.

Remember, tailoring your strategy to your unique needs is key to achieving sustainable success.

Start today by taking that first step toward a future where your investments truly reflect who you are.

References