Every day, we make dozens of financial decisions—small and large—that shape our future. While traditional economics assumes we treat every dollar identically, real life paints a different picture. Our minds assign labels, rules, and emotions to money, guiding our spending, saving, and investing in ways we often can’t articulate. This phenomenon, known as mental accounting, offers a window into our deepest financial biases and provides an opportunity to harness them for better outcomes.

By understanding these hidden mental ledgers, you can transform fleeting impulses into lasting strategies and turn subconscious patterns into powerful allies on your path to prosperity.

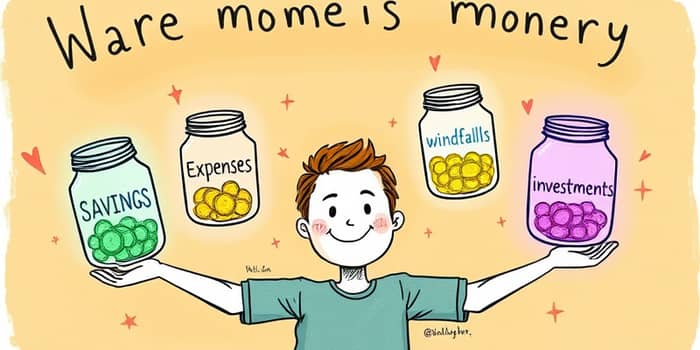

The term “mental accounting” was introduced by Richard Thaler to describe the subjective mental accounts and emotional labels we create to organize financial activities. Rather than viewing money as entirely interchangeable, we subconsciously sort dollars into categories such as daily expenses, long-term savings, windfalls, and risk capital. This cognitive framework allows us to navigate complex choices with less effort but also introduces biases that can derail our best intentions.

Mental accounting acts as a strategic self-control tool for everyday spending, enabling us to budget, monitor spending, and preserve emotional well-being by limiting the brain’s exposure to overwhelming financial details. However, the same mechanism can lead to irrational behavior when subjective labels override objective needs.

Consider the classic tennis club scenario: after buying a costly, non-refundable membership, an injured player persists in games to avoid admitting loss, enduring physical pain to justify the expense. This single example captures how mental accounting can overpower rational judgment and amplify discomfort.

Mental accounting unfolds through classification and framing. First, we decide to set aside specific budget categories—assigning each dollar a mental tag. Then we determine whether to integrate or segregate gains and losses. For instance, multiple small wins and a single large loss might be perceived differently when fused or separated, influencing our satisfaction and decisions.

Moreover, the pain of paying varies significantly by payment method: cash triggers more acute pain than credit, and digital wallets often feel painless. Recognizing these emotional triggers empowers us to choose payment styles that align with our goals.

This table illustrates how identical sums can spark contrasting impulses depending on their mental labels.

By channeling mental accounting biases toward positive habits, you can simplify your financial life and build momentum toward your most important objectives.

Awareness of these traps is the first step toward circumventing them. A simple monthly review ritual can highlight imbalances before they become entrenched.

Remember that mental accounting isn’t inherently negative. Like any lens we use to perceive the world, it can distort but also clarify. When guided intentionally, it becomes a compass rather than a cage.

Maintaining momentum requires blending strategy with self-compassion. Periodic check-ins—weekly or monthly—allow you to adjust mental categories in response to life changes such as job transitions, family milestones, or shifting goals. Treat these sessions as opportunities to celebrate progress and realign resources.

Allow yourself grace with small indulgences, recognizing that deliberate treats can reinforce disciplined habits and sustain motivation. A tiny joy purchased from your “play money” jar can feel like a reward rather than a lapse.

Finally, don’t hesitate to seek community or professional support. Discussing budgets and mental accounting tactics with mentors or peers creates accountability and fresh perspectives. When two minds collaborate, they can unravel hidden biases more swiftly and craft solutions that resonate personally.

By illuminating the invisible structures of your financial thinking, mental accounting shifts from a covert saboteur into a powerful framework for conscious choice. Your money becomes more than currency—it transforms into a narrative you author, chapter by chapter, toward the life you envision.

Transform mental accounting into your advantage today by mapping your mental accounts, redesigning each one with intention, and watching how small adjustments yield profound transformations over time.

References