When we think of investing, images of stock charts and complex algorithms often come to mind. However, the true force behind market movements is not just data; it is the intricate dance of human psychology that governs our financial choices. This profoundly human story reveals how emotions, from fear to overconfidence, can steer portfolios in unexpected directions.

Behavioral finance, a field that blends psychology with economics, challenges the myth of the rational investor. It shows that our minds are wired with biases that can lead to costly mistakes, such as panic-selling during downturns or holding onto losing investments out of pride. Understanding this psychological undercurrent in markets is essential for anyone looking to build wealth wisely and sustainably.

Pioneered by researchers like Daniel Kahneman and Amos Tversky, this discipline highlights how cognitive errors and emotional responses drive decisions. From the evolutionary roots of loss aversion to the social dynamics of herding, our financial behaviors are deeply ingrained. Recognizing these patterns empowers investors to navigate uncertainty with greater awareness and resilience.

Behavioral finance integrates insights from neuroscience and psychology to explain why people often deviate from logical decision-making. It posits that markets are not always efficient, as emotions and biases can cause price distortions. This perspective offers a more nuanced view of investing, where human elements take center stage.

Studies have shown that emotions like anxiety can reduce risk tolerance, while overconfidence might lead to excessive trading. The interplay between cognition and feeling creates a complex landscape for investors. By acknowledging this, we can start to see investing as a journey of self-discovery, not just number-crunching.

Our minds are prone to systematic errors that influence how we handle money. These biases, often subconscious, can derail even the most well-intentioned strategies. Below is a table summarizing some of the most common biases and their impacts.

These biases are not just abstract concepts; they manifest in real-world scenarios, such as during financial crises or personal investment milestones. For instance, loss aversion might make an investor sell a winning stock too early, fearing a downturn, while overconfidence could prompt risky bets on speculative assets.

To combat these tendencies, it is crucial to first recognize their presence. Self-awareness is the first step toward mitigating their effects and making more informed choices.

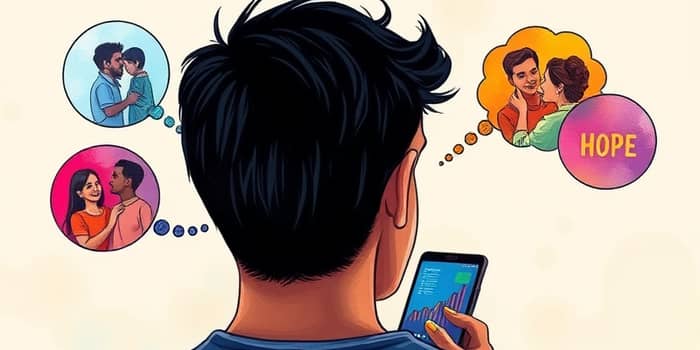

Emotions play a dual role in investing, both hindering and helping our financial journeys. On one hand, fear and greed can trigger impulsive actions that harm long-term goals. On the other, positive emotions like love for family can motivate disciplined saving and investing for future security.

Yet, emotions are not inherently bad. They provide the motivation to plan for retirement or save for a child's education. The key is to harness them constructively, rather than letting them control decisions.

Research indicates that about 40% of an advisor's value comes from emotional support, highlighting the importance of psychological guidance in financial planning. This statistic underscores that investing is as much about managing feelings as it is about analyzing data.

Overcoming biases requires intentional effort and systematic approaches. By adopting specific strategies, investors can reduce the impact of emotions on their portfolios.

Another effective method is to work with emotions rather than against them. For example, channeling the desire for family security into a consistent savings plan can turn emotional drives into powerful motivators for financial health.

Incorporating these strategies into daily habits can transform investing from a stressful endeavor into a more mindful and rewarding process.

Applying behavioral finance insights does not require a degree in psychology. Simple, actionable steps can make a significant difference in investment outcomes.

These tips emphasize proactive management of the human element, ensuring that emotions serve as allies rather than adversaries in wealth-building.

The human element extends beyond individual portfolios to shape entire markets and economic systems. Behavioral biases contribute to phenomena like bubbles and crashes, where collective emotions drive prices away from fundamental values.

Understanding these dynamics is crucial for professionals in finance, from portfolio managers to policymakers. It allows for better risk management and more accurate predictions of market trends.

Moreover, behavioral finance highlights the evolutionary roots of our financial behaviors, such as loss aversion stemming from survival instincts. This perspective encourages empathy and patience in navigating financial challenges.

Embracing the human element in investing is not about eliminating emotions but about integrating them wisely. By recognizing our psychological tendencies, we can craft strategies that align with both our rational goals and emotional needs.

This journey invites us to see investing as a path to personal growth, where self-awareness leads to better financial outcomes. As Mark Twain once hinted, it is often our certainties that lead us astray; humility and learning can illuminate a wiser way forward.

In the end, the numbers on a spreadsheet tell only part of the story. The true narrative of investing is written by the hearts and minds of people, striving for security, purpose, and prosperity in an uncertain world.

References